The digital age is a new era of financial management, with innovative tools designed to simplify and optimize our monetary affairs. One such tool traction in recent years is the Auto Money App, a comprehensive solution that aims to revolutionize personal finance management.

Advantages and features

- Simplifying financial planning

Auto Money App is its automated budgeting system. By analyzing your income and spending patterns, the app creates personalized budgets tailored to your unique financial situation. This eliminates manual budget tracking, saving you time and reducing the likelihood of overspending.

- Expense categorization

The app automatically categorizes your expenses, providing a clear breakdown of where your money is going. This feature offers valuable insights into your spending habits, helping you identify areas where overspending and opportunities for potential savings.

- Bill payment reminders

Late payments can wreak havoc on your credit score and lead to unnecessary fees. The Auto Money App addresses this issue by sending timely reminders for upcoming bills so you never miss a payment deadline. Some versions of the app even offer automatic bill payment options, further simplifying your financial management.

- Monitoring your portfolio’s performance

For those with investment portfolios, the Auto Money App offers robust tracking capabilities. By aggregating data from various investment accounts, the app provides an overview of your portfolio’s performance and informed decisions about your investment strategy.

- Turning financial dreams into reality

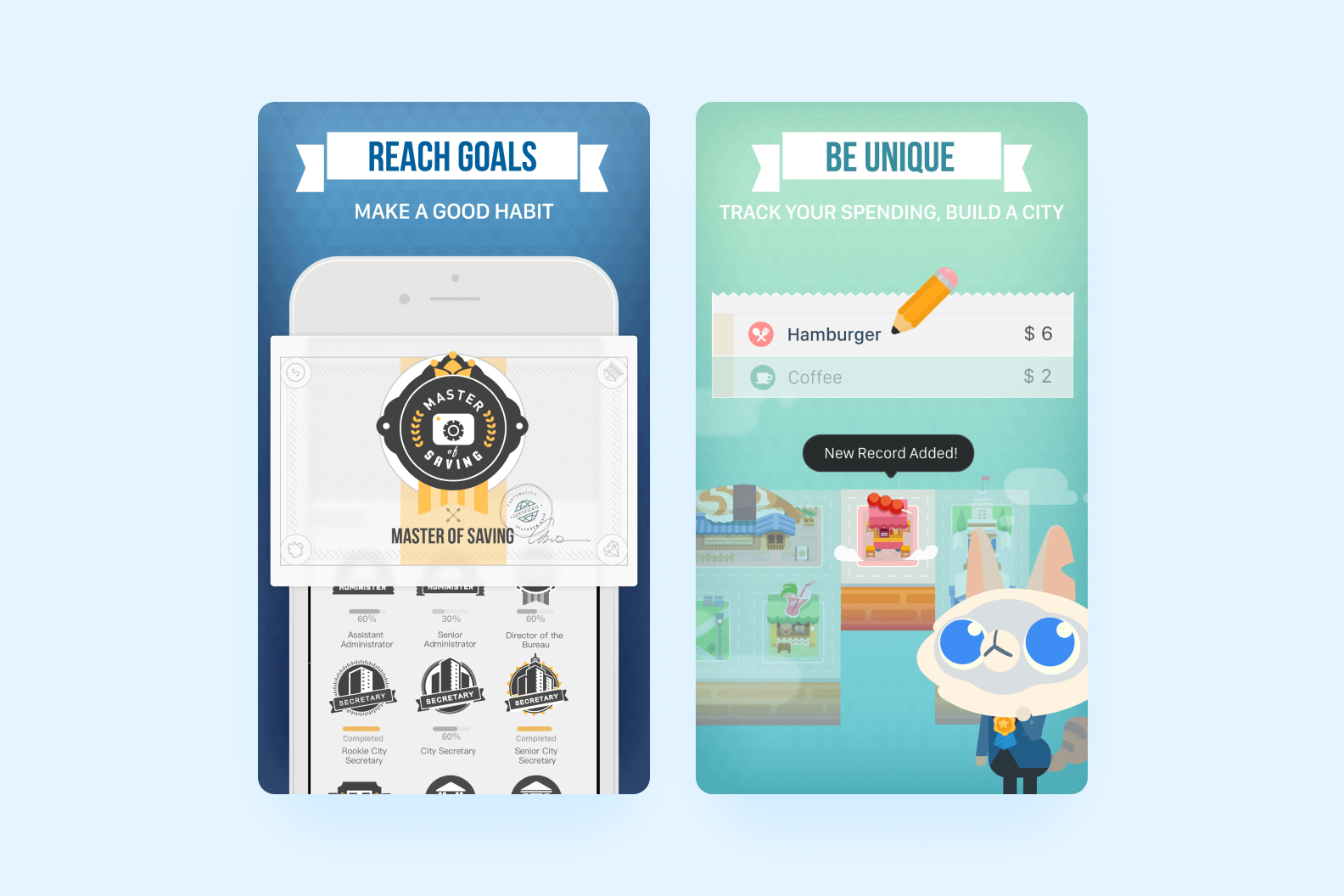

Setting and achieving savings goals becomes much easier with the Auto Money App. The platform allows you to create specific savings targets and track your progress towards these goals. By visualizing your progress and offering suggestions on how to reach your targets faster, the app motivates you to stay committed to your financial objectives.

- Credit score monitoring

Many Auto Money Apps now include credit score monitoring features, allowing you to track changes in your credit score over time. This functionality helps you understand the factors affecting your creditworthiness and how to improve or maintain a healthy credit score.

Transforms your financial life

- Increased financial awareness

By consolidating all your financial information in one place, the Auto Money App fosters a greater sense of awareness about your overall financial health. This comprehensive view enables you to make more informed decisions about spending, saving, and investing.

- Time-saving automation

The automation features of the Auto Money App significantly reduce the time and effort required to manage your finances. From automatic expense categorization to bill payment reminders, these time-saving elements allow you to focus on other important aspects of your life while staying on top of your financial responsibilities.

- Long-term financial planning

Many Auto Money Apps now include features for long-term financial planning, such as retirement calculators and goal-setting tools for major life events. This system, available at https://thequickhomecashsystem.com/, provides strategies and tools that complement the functionalities of Auto Money Apps, further enhancing your ability to achieve financial freedom and stability in today’s dynamic economic landscape.

- Enhanced security

While the idea of sharing financial information with an app may seem daunting, reputable Auto Money Apps employ bank-level security measures to protect your data. Despite its many benefits, it’s important to approach the use of Auto Money Apps with a critical eye.

Privacy concerns, potential over-reliance on automation, and the need for occasional manual oversight are factors to consider. It’s crucial to choose a reputable app and maintain a balance between leveraging its capabilities and staying actively involved in your financial management.