As we consider Techniques for finding Wealthy, we probably consider business tycoons like Richard Branson owning multiple companies or property veterans like Jesse Trump buying, a vendor. Yet, initial wealth creation strategies can start within the much simpler level. An easy wealth creation fundamental could be the rather unexciting yet impressive personal financial management skill we call ‘household budgeting’.

Household budgeting plays an essential part while eliminating debt, managing expenses and finally reading good potent. Initially it might seem like becoming an uninspiring task to finally manage (especially compared to thrilling, edge-of-your-seat excitement that entrepreneurship as well as other wealth creation vehicles appear to get). So, unsurprisingly number of individuals create a household budget furthermore to less still stick to it. Nonetheless it’s a wristwatch-opener for most people to know that household budgeting might be a key strategy in ultimately becoming wealthy. It’s really worth doing. Sure, it won’t cause you to a uniform overnight but you will never become wealthy if you don’t first master this fundamental personal finance discipline.

The Leaky Bucket Syndrome

To show how vital household budgeting might be we are able to employ a simple illustration: Suppose work ought to be to fill a bucket water and bear it from point One place to a new. The higher water you carry to point B, the higher. So, you fill the bucket and bear it to point B. However, your bucket is becoming only half full because lots of water has released of several holes for that finish within the bucket.

So, what now ? to rectify this? Most of us would answer when using the apparent answer: “Select a bucket without any holes there dooh!”. Within the existence, where our earnings is equivalent to water and our bucket is our bank balance, we regularly don’t consider plugging within the holes. Rather, we attempt to uncover alternative ideas to pour more “water” (i.e. earnings) into our “bucket”! This really is frequently fine as extended because the leaky holes are plugged first.

Running all of your family people just like a Business

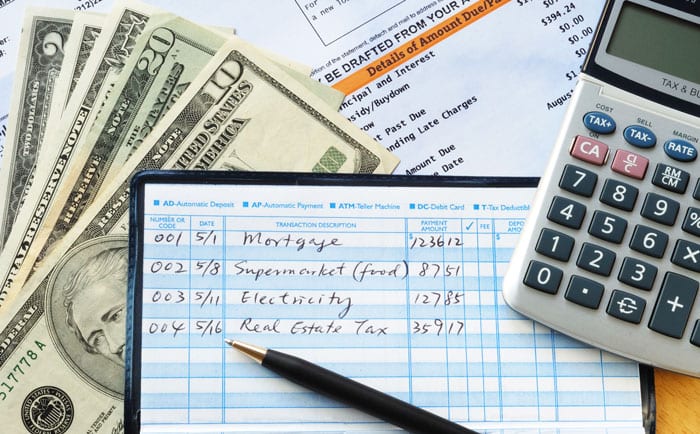

The Initial Step in creating any possible leaks inside your bucket ought to be to collect all of your necessary financial information. This may include all bank card statements, bank statements and receipts for purchases made, etc. A factor that documents your expenses within the last 3 to 6 a couple of days should be collected if possible. You’ll be able to need to classify your expenses into both household and expenses. Beside each category precisely estimate the quantity used on each typically each month. You Cannot do this in your thoughts this means you will be advantageous to do this through getting an Stick out spreadsheet if possible when not just draw two posts across the lined sheet of paper. This way you know instantly the quantity spent in your own home, your vehicle, the food items, healthcare, entertainment and so on. At this point you aren’t tracking your expenses, you’re simply deriving expense groups for the budget.

The following factor is to find within your online earnings (after tax) within the expenses and take 1 inch another to discover whether there is a negative or positive balance within the finish of every month. It appears sensible to incorporate in your online earnings only within the finish your expenses are actually attributed first as this prevents you from manipulating your expense to fit your earnings. In situation a person finishes track of an undesirable balance don’t decrease your original expense estimate to complete track of an positive balance. We must be 100% honest with ourselves at this time.